Page 12 - Holiday_Club_Annual_report

P. 12

a high level and to improve the profitability of spa hotel The development of Russian customers’ purchasing pow-

business significantly. The investments in construction er and the Russian economy may be considered as a risk

during the financial year 2014-2015 will focus on Saimaa for Saimaa resort business operations.

resort both for timeshare and villas business. A villas con-

struction project will be started also in Åre, Sweden. The unstable financial climate may present obstacles to

business operations in the form of tighter terms for cus-

Concerning spa hotels, the focus continues to be on in- tomer financing and funding for new projects. A signifi-

creasing turnover. Holiday Club concentrates its invest- cant proportion of consumer sales of timeshares are han-

ments and activity on holiday destinations where the dled as con-sumer financing via partner banks, which is

entire range of products and services can be offered to strongly influenced by interest levels remaining quite low.

customers, including timeshare and villas apartments. Any significant disturbances or extreme situations in the

The company sold the Ylläs Saaga Spa hotel business to financial markets would naturally first hinder the financ-

Lapland Hotels in October 2014 as part of this strategy. ing of new projects and, in prolonged circumstances, also

affect normal business operations.

Assessment of the most significant

operational risks and uncertainties Approximately 81% of the parent company’s loan portfolio

is protected by fixed interest rates.

A fundamental risk in business operations is the possible

deterioration of consumer confidence in their own financ- Personnel-related information

es or a dramatic decline in consumer purchasing power.

The sales of the company’s basic products, timeshares, The average number of personnel employed by the group

villas apartments and spa holidays, have been reasonably during the financial year was 722 (754) persons and the

strong as such in these times of sustained economic un- em-ployee expenses were €34.6 million (€33.1 million).

certainty. A decrease in consumer trust and/or purchas- The average number of personnel employed by the par-

ing power would, however, have a negative impact on de- ent company was 516 (531) persons and its employee ex-

mand for the company’s products. penses were €26.8 million (€25.7 million). The method of

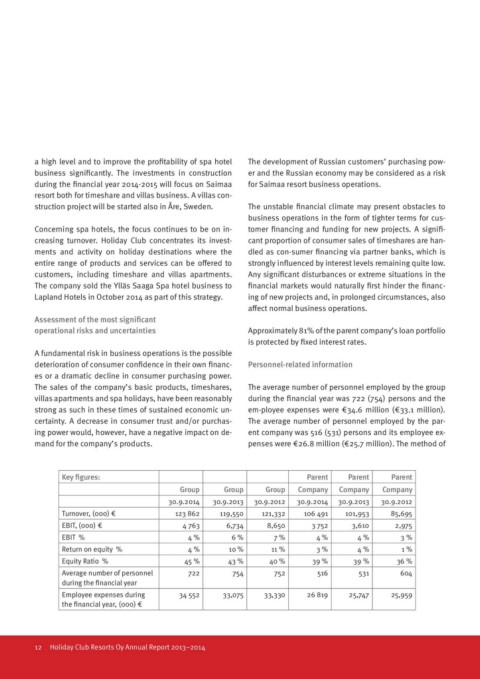

Key figures: Group Group Group Parent Parent Parent

30.9.2014 30.9.2013 30.9.2012 Company Company Company

Turnover, (000) € 30.9.2014 30.9.2013 30.9.2012

EBIT, (000) € 123 862 119,550 121,332

EBIT % 4 763 6,734 8,650 106 491 101,953 85,695

Return on equity % 4% 6% 7% 3 752 3,610 2,975

Equity Ratio % 4% 1o % 11 % 4% 4% 3%

Average number of personnel 45 % 43 % 40 % 3% 4% 1%

during the financial year 722 754 752 39 % 39 % 36 %

Employee expenses during 516 531 604

the financial year, (000) €

34 552 33,075 33,330 26 819 25,747 25,959

12 Holiday Club Resorts Oy Annual Report 2013–2014